Why despite trying to be financially responsible and working hard you seem to be poor in Germany compared to others?

Small savings like reusing shopping bags or cutting down on snacks help, but won’t change your finances much. The real problem? Ignoring bigger habits and expenses that drain your money while people you know keep getting rich.

The truth is, you’re working hard, but there are financial traps holding you back. So in this guide , we’ll discuss 7 things keeping you poor in Germany.

7 Things keeping you poor in Germany

Insurance Costs: How Overpaying Keeps You Poor in Germany

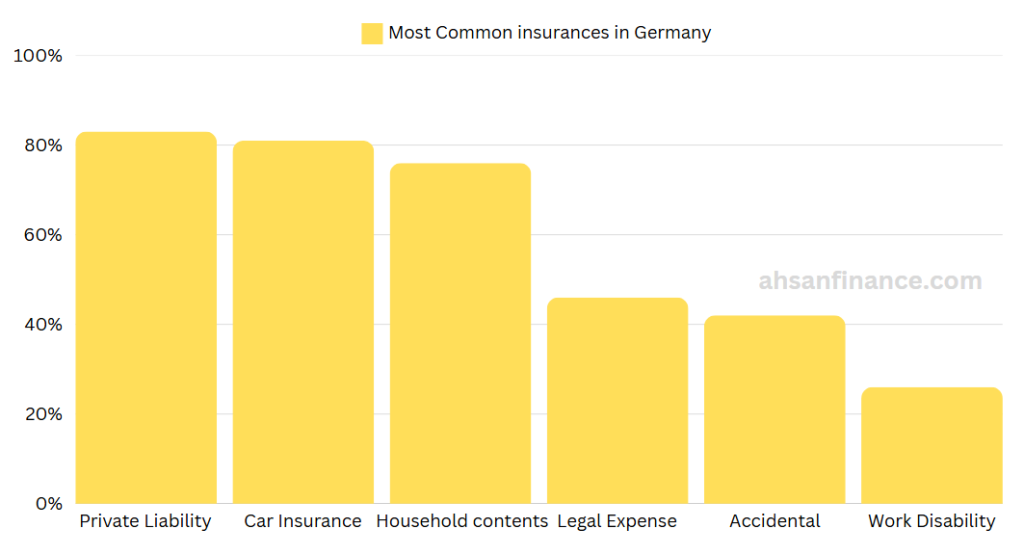

Germany is the land of insurance, from personal liability and legal insurance to coverage for getting stuck in an elevator. Yes, for just twelve euros a year, you can get this unique policy.

All jokes aside, statistics show that the average German citizen has six insurance policies. This may seem normal to many but such a number of contracts cost a significant amount of money either monthly or annually. Thats why, it makes sense to have a look at which insurances you have.

What Insurance should you choose in Germany?

Insurance should protect you from risks that could ruin your financial life. This means you should insure against situations where a big loss could lead to financial disaster, like personal liability. If you cause harm and have to pay large amounts for many years, this could lead to bankruptcy. Liability insurance can protect you from this risk. This is the most important non-mandatory insurance that you must have.

Some types of insurance are not necessary because the damage won’t destroy your finances. For example, travel luggage, phone, or glass breakage insurance. These won’t protect your life, and you could afford to pay for them yourself if needed.

What you can do is list all the mandatory and optional insurances you have and how much you pay for it each month.

- Health Insurance

- Car Liability insurance

- Partial or Fully comprehensive car insurance

- Personal Liability insurance

- Legal insurance

After listing them all, try to figure out which insurance can you cancel. For example, Do you really need to have a Fully comprehensive car insurance or Vollkasko? or would it make sense to shift to partial coverage or teilkasko?

Is it absolutely necessary to have the house content insurance or can you get by with just private liability insurance. Once you have figured out which insurances are not worth it for you, next step would be to compare your insurance options.

How I reduced my Insurance Premium

For example, my Private liability insurance premium increased to 89€ and I had a right to special termination. I asked my insurance provider if I could get a discount, but they couldn’t offer better terms. So I quit my contract and found another insurance for half the price with even better coverage. Therefore it can be very helpful if you compare your insurance.

Another thing you could do to help save money is to bundle all your insurances at a single provider. In some cases it can be cheaper when you can bundle your private liability, card liability and others at a single provider.

Car Payments: Is Your Vehicle Draining Your Wealth?

Owning a car is often seen as a necessity, but it’s crucial to understand how it can significantly impact your financial health over time. Many people don’t realize the full consequences of purchasing a car on credit. Especially when living paycheck to paycheck.

While it may seem reasonable to take on a car payment—especially with good loan terms. This decision can have long-term financial implications. The average car payment in Germany is around 310€, which represents approximately 11% of the average take-home pay.

Now, consider how your financial situation could evolve over one, five, or ten years if you instead invested that €300 monthly payment into your future, such as in the stock market or other growth assets.

This is how a car’s value decreases in Germany

One of the most overlooked aspects of car ownership is the array of hidden costs that can drain your finances:

A car’s value can plummet by nearly 50% within the first three years. This immediate loss impacts your net worth, turning a new car purchase into a significant liability.

Beyond the purchase price, cars come with a slew of recurring expenses, including:

- Fuel

- Insurance

- Repair costs

- Inspection fees (TÜV , HU)

- Parking.

These ongoing costs can add up quickly, further straining your budget.

Choosing to finance or lease a car means additional interest payments, increasing the overall cost of ownership. These financing costs can make a car significantly more expensive over its lifetime compared to buying one outright.

To avoid these financial pitfalls, it’s essential to rethink your approach to car ownership. One strategy is adopting an extreme frugal mindset to save up for a reliable, used car that you can pay for in cash. For example, my first car cost me 4000€ and I kept it for more than 2 and a half years. I bought it for cash without burdening me with monthly payments. So By forgoing a new car and its associated payments, you can redirect that money into investments that build wealth over time.

Obviously, the decision of how much to spend on a car should be made with careful, rational consideration rather than emotion. Buy overpaying or buying an extremely expensive Liability can heavily influence your financial health and keep you poor in Germany.

Related Guide: Buy, Finance or Lease a Car in Germany? Which is worth it?

Lifestyle Inflation: The Silent Trap Keeping You Poor in Germany

When people get a raise, they often fall into a trap called lifestyle inflation. This means they start spending more money as their income goes up. I have experienced this myself. When I started my professional career in Germany I was quite frugal with my spending as I had just spent about 2 years as a student.

Over time, I started making more money. Each time I got a raise, I felt the urge to spend more. and sometimes, I did spend more. But spending more never made me happier.

This is why many people, even those making over 100,000€ a year, still feel poor in Germany. As soon as they get a raise, they buy a new car. Then they upgrade to a bigger house. They buy unnecessary things. Now These things aren’t bad by themselves, but they come at the cost of financial stability.

So, now when I get a raise, I pretend I didn’t. I put that extra money into the stock market using my investment account.

Related Guide: How to invest your first €100 in Germany

Impulse Buying: How Small Purchases Add Up to Big Financial Losses

Many of us struggle with impulse buying, especially when we’re bored or emotionally drained. This habit is particularly common among those who frequently browse deal websites or shopping apps.

I remember spending at least five minutes every morning checking for deals on an app called Mydealz, and regularly visiting the discount sections on Amazon and eBay. While I did find items at discounted prices, I often bought things I didn’t really need.

For instance, purchasing a 200-euro item at a 50% discount isn’t saving money if the item is never used—it’s just a waste of 200 euros. To break this cycle, I eventually uninstalled all the discount apps.

Delayed Gratification and Dopamine Relationship

Research indicates that the brain releases dopamine in anticipation of a reward, such as when shopping online. This anticipation phase triggers a higher dopamine release than when the actual purchase arrives. The pleasure from buying fades quickly after receiving the product, as dopamine levels drop significantly. To counteract this, I set a two-week waiting period before buying anything non-essential. This helps me assess whether I truly need the item.

Impulse buying is more likely when we are tired, emotionally unstable, or indecisive. To manage these impulses, it’s essential to have strategies in place. Start by planning ahead and creating a shopping list. Additionally, give yourself a reconsideration period— I have set a waiting limit of at least 2 weeks to buy something that is not absolutely essential. This approach reduces regret and ensures that my spending aligns with my priorities.

Subscriptions: Hidden Monthly Costs That Keep You Stuck

In addition to Insurances, ongoing Contracts and Subscriptions also contribute to you not being able to realize your financial independence Dream in Germany. They keep you poor in Germany!

We often subscribe something and forget about it, obviously not AhsanFinance. All jokes aside, Just open up your banking app and have a look at all those small subscription fees that are cut on the first of every month. Netflix, Amazon Spotify or Maybe even the Bahn Card which auto renews every year.

What about that Gym Membership? I wont go to the extreme by saying that you should cancel your Gym Membership. We already spend too much time on our screens already. But if you already go maybe once a week, then perhaps look into pay per visit options in your gym.

For example my Gym had a 52 visits a year card for the price of 6months gym membership fee. When I saw that it felt like a robbery. I couldn’t understand the pricing, but if you are someone who only visits the gym 3 to 4 times a month. This can save you half your membership fee.

Besides subscriptions, check your contracts like your phone or internet contracts. Can you get more for the same price or pay less? The same goes for electricity and gas rates. You can often switch providers once a year, and it’s definitely worth comparing rates.

Related Guide: Things I wish I knew when I came to Germany

Listening to the Wrong People: Bad Advice That Keeps You Poor in Germany

Its ok Listen to your friends colleague and other people around you, but be careful whose financial advice you follow. I have a rule: I don’t take financial advice from anyone whose financial situation I wouldn’t want for myself. If your friends, parents, or relatives give you money advice but they aren’t doing well financially, it’s usually best to take it with a grain of salt.

On your way to your financial Freedom journey in Germany you might be taking the right decisions. Perhaps living below your means. Driving a good but an older car that you have paid in cash.

But then you will come across people advising you to buy a better car, get a bigger apartment , buy this thing or that thing. Please dont listen to those people.

Yes some of that advice could be correct for them but not for you. You have to decide what you want for yourself. Also please do not follow the advice of youtubers and other influences blindly.

I would be happier if you disagreed to even things that I have mentioned in this video than completely agreeing with everything I say. Because your situation is different and not everything applies to you and that is ok. Talk to people , listen to multiple sources and then decide what suit you. Let me know in the comments which points in this guide you disagree or agree with and why.

Missing Out on Investing: The Biggest Mistake That Keeps You Broke

As your wealth grows, it’s crucial to understand the impact of inflation, opportunity costs, and investment costs on your finances.

Many expats have large amounts of money sitting in checking accounts. While these funds are secure, they generate minimal or no returns, defeating the primary purpose of investing.

Worse, inflation gradually erodes the purchasing power of this money. Specially since the past couple of years. Because of that you miss out on the potential gains when money isn’t invested in higher-yield assets like real estate or international stocks.

The combined effect of inflation and missed investment opportunities can significantly impact wealth over time. For example, if you kept €20,000 in a checking account for 20 years, its purchasing power would decrease by about 25%, leaving you with the equivalent of €15,000. On the other hand, investing the same amount in the capital market with an average 7% return would grow it to over €77,000.

Why you need an Emergency Fund

Now obviously It’s wise to keep three to four months’ worth of net income in a checking or savings account as an emergency buffer. But The rest should be invested.

Just look around in your friends and professional circle. Most of the financially stable people would have a large net worth in either Real Estate or in the stock market. Now as an Expat in Germany who doesnt know much about these thing it can be very intimidating to get started with. Worry not, in this guide I share how to get started with Real Estate in Germany.

Disclaimer: None of the content in this article is meant to be considered as legal, tax or investment advice, as I am not a financial expert or a lawyer and am only sharing my experience with stock investing. The information is based on my own research and is only accurate at the time of posting this article but may not be accurate at the time you are reading it.