How to write a Will in Germany is one of the most important things to know as a Foreigner In Germany. As this is probably one of the most important documents you need to have as an Expat in Germany.

So why am I saying that a Will is one of the most important docuemtns you must have?

To answer that, you must answer this question? Why did you come to germany? For a better life for yourself? Better work opportunities? Safety? Building Wealth or something else?

If you came to Germany just like most of us, to have a better life for yourself and your family. What would happen if you are not there anymore. How would things function after that?

I know these are some very deep questions but while we build our wealth in Germany, we also have to look into Estate planning. So that the people we love are taken care of if we are not there for them anymore.

Inheritance law in Germany

To understand this we have to first look at the Inheritance law in Germany:

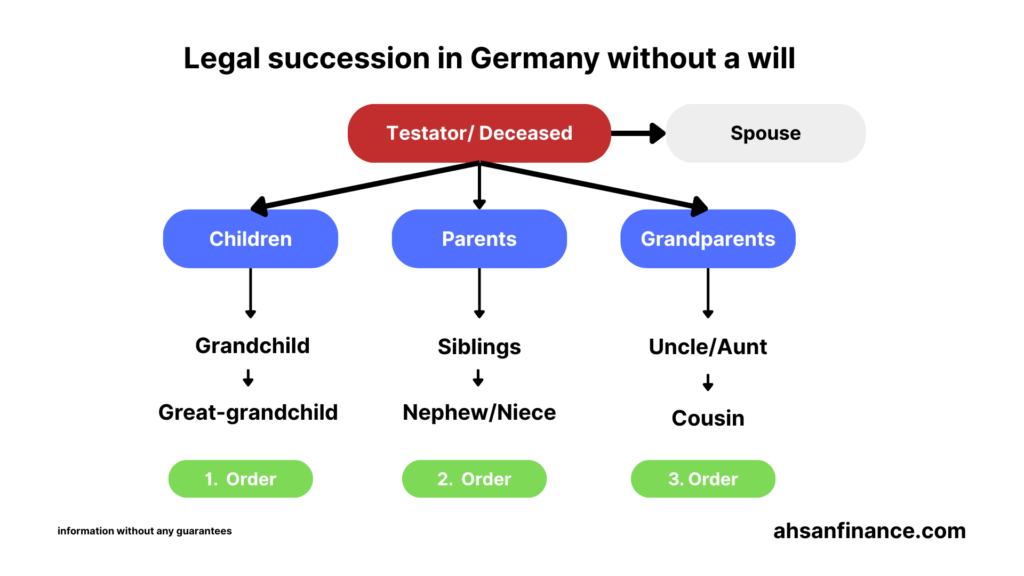

This law decides who gets a person’s things after they are no longer here. If there is no will, the estate succession will be followed according to the German Civil Code.

Sometimes this works well. For example, when the family is supposed to get everything.

But often, the rules don’t match what the person wanted. The law doesn’t give anything to partners, stepchildren, godchildren, or friends. If you want to leave something to these people, you must write a will.

Also, if one spouse dies, the other does not automatically get everything. If there are children, they get half. The other half goes to the surviving spouse. All of them become co-heirs. That means they share the house, money, car, and other things together. They must agree on what to do, like selling the house.

But for expats, things might not be as simple or quick because your whole family might not be living in Germany or even the EU.

Related Guide: 7 Things Keeping you POOR in Germany

Asset Distribution if there is no Will in Germany

By default, The husband or wife always gets part of the inheritance even if children or other family members are alive.

How much the spouse gets depends on different situations:

If the person had children the Spouse gets half of everything

If there were No children, but the deceased person had siblings or parents the Spouse gets three-quarters.

So depending on your specific situation the default might not be a great thing.

But If you do not agree with the legal regulations , for example because you want to disinherit a relative or because you want to remember someone who is not related to you, or change the percentages then you should draw up a will.

Exactly How to Write your Last Testament or Will in Germany?

In your Will there are 6 things that need to be covered.

1. You Choose Who Gets Your Things

The most important part of a will is choosing who should get your money and belongings. This person is called your heir. You can name your spouse, children, grandchildren, or even friends.

You can choose one person to get everything. That person becomes your sole heir. This avoids fights between family members. But remember they don’t just get your money. They also take care of your debts, funeral, and your household.

You can also disinherit someone, but close family like your children or parents usually still get a legal share. You can’t fully leave them out.

2. You Can Leave Specific Things to Someone

In your will, you can leave a special item to someone without making them an heir. This is called a legacy. This can include your classic car, the apartment you rent out , a painting or even a ring.

If you leave someone “cash,” it means coins and banknotes not money in a bank account. So write clearly what you mean.

3. Giving Extra to One Heir

You can also leave something extra to one of your heirs. But you need to say whether it should be counted as part of their share or given in addition.

For example

“I give both my children equal shares. My daughter Sara also gets my stocks without it being deducted from her share.”

Write clearly so no one has to guess what you meant.

4. You Can Choose a Backup Heir

Sometimes, the person you choose to inherit may decease before you. That’s why it’s smart to name a backup, also called a substitute heir.

For example

“My son should be my heir. If he goes before me, my sister will inherit.”

5. You Can Appoint an Executor

An executor is someone who makes sure your wishes are followed. They help divide your things and manage the paperwork.

This person doesn’t have to be in the family. But They should know about taxes and inheritance law.

Executors usually get paid from your estate. You can say how much they get in your will.

For example: 1% of everything you leave behind, plus sales tax.

6. Setting Rules or Conditions

You can also write conditions in your will. These are rules someone must follow to get what you leave them.

For example: My Son gets the apartment only if he finishes his bachelors or my daughter gets €5000 on her 15th birthday and the rest after she turns 18. These are acceptable conditions but things like “You must visit me six times a year to inherit.” or “You must marry this person to get your share.” are too personal or controlling. And Courts often find them unfair or “immoral.” so they won’t be followed.

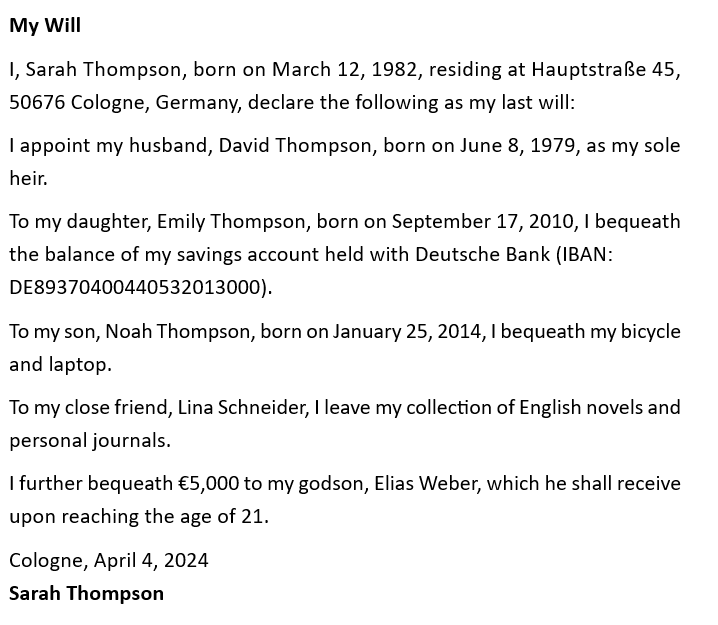

Here is a sample will that follows all the six things but is still invalid.

Is a hand written will in Germany valid or not?

If you make your own will, you have to hand write it yourself. A digital document would not be valid if you do it on your own. So Instead of writing your will yourself, you can also contact a notary to have your will drawn up.

Writing a Hand Written Will

A handwritten will allows you to write your wishes on your own, anytime and anywhere, without any cost. You stay flexible and can change or destroy it whenever you want. You can also choose to store it at the local court for safety and you can even write a joint will with your spouse. However, there are risks: it could be lost, changed, or not found, and it might be unclear or invalid if not written properly.

Writing a Notarized Will

A notarized will, on the other hand, is created with legal advice and assistance at a notary’s office. It is officially stored and secure from tampering. It often replaces the need for a certificate of inheritance, saving your heirs extra costs. But, it requires an appointment and notary fees apply—even for updates.

For a notarized will You must pay a fee based on the value of your assets at the time the will is drawn up. For example, if your estate is worth €25,000, the fee is about €150 and if your estate is worth €100,000, you pay about €350.

In case you want to leave whole inheritance to your spouse. The Berliner Testament allows spouses to declare each other as sole heirs in a joint will. Only after both spouses have passed away would the next in line receive their inheritance.

Related Guide: Sending Support to Family from Germany? Here’s How to Claim It on Your German Taxes

Why you need a Postmortem power of Attorney in Germany?

In addition to your Will in Germany you also need a postmortem power of attorney.

Because of the will , all legal heirs will get their rightful share, but this whole process can take 3 to 4 months during which time sensitive and critical payments might come due. In this case the postmortem power of attorney will enable an authorized person to act on your behalf.

The granting of a post-mortem power of attorney can be done verbally. However, for obvious reasons, it is recommended to choose a written form and, in certain cases, to have it notarized. This power can be revoked at any time by the issuer or the heirs of the deseased.

Why is a power of Attorney important in Germany?

The greatest advantage of granting a postmortem power of attorney is that the authorized representative is able to act immediately after the principal’s demise , without having to wait for the issuance of a certificate of inheritance , the opening of a last will and testament, or the issuance of a certificate of executorship.

And in case you did not know, the inheritence will be taxed over a certain amount.

| Relationship to the deceased person | Inheritance tax allowance |

|---|---|

| Spouse or registered partner | 500.000 Euro |

| Child or stepchild and grandchild (if parent is already deceased) | 400.000 Euro |

| Grandchild whose parents are still alive | 200.000 Euro |

| Great-grandchild and parents who inherit from their children | 100.000 Euro |

| Sibling | 20.000 Euro |

After the tax free allowance, these tax percentages will be applied on the inheretance. This might come as a shock to you but even if both the spouses used the same bank account or an investment account but the account was in the name of just 1 person. In that case inheritence tax would apply on these accounts.

So my recommendation would be to have at least 1 main joint account with your spouse if your cash and investment accounts are above the 500 thousand threshould.

What else should you have?

Although not entirely necessary but I also recommond that you have an additional document stating all your important information. Your investment accounts, primary email, any crypto pass phrases etc. There are so many things here and I can make a dedicated video on the topic but i think you get the general idea about it.

Now these two documents are essential for your estate planning. But while you are here and working hard for yourself and your family, making a financial plan should be amoung one of your highest priorities. You can read my detailed guide on Financial Planning for Expats in Germany to get started.

Disclaimer: None of the content in this article is meant to be considered as legal, tax or investment advice, as I am not a financial expert or a lawyer and am only sharing my experience with stock investing. The information is based on my own research and is only accurate at the time of posting this article but may not be accurate at the time you are reading it.