I got the Advanzia Credit card more thant 9 years ago. Long ago a couple of my student friends were discussing free credit cards in Germany. There wasn’t a clear favorite, but the majority seemed to like the Advanzia Gebührenfrei Credit Card.

I didn’t get this free credit card right away, but after a couple of months. I knew I had to get the Advanzia Credit Card because of its great features and excellent acceptance rate.

Advanzia Credit Card Review

Is Advanzia Credit Card actually free?

Yes, the Advanzia Credit Card is Actually Free. It’s been more than 9 years now, and I’m still very happy with the Advanzia Gebührenfrei Credit Card.

Thats why in this guide I wanted to tell you all about the features of this amazing credit card. What you need to be cautious of when using it, and my personal experience with it over the past 9+ years. Trust me, this COULD be the best credit card in Germany for most people.

Free Credit Card in Germany

The name of the credit card says it all “Gebührenfrei” —it’s free! That means there’s no maintenance fee when you get it. But how can it be free? Is there a catch? Well, like all credit cards, Advanzia Bank makes money from interest on late payments. So, if you’re careful with your payments and pay on time, you can use if for free just Like I have been doing for more than 8 years.

Who can get Advanzia Credit Card?

All you need is a valid residence permit in Germany. Anyone can apply students, employees, even spouses who don’t have a job. Up until 2 years ago you could get this free credit card with just a city registration form but now you need to verify your identity using a Valid ID document. So as long as you have one, you can apply for this Free Credit Card in Germany

How to Get Gebührenfrei Credit Card

The signup process is very simple, just click this link.

Fill out your details, like your name, email, address and phone number and click submit. After that you will receive an email with a link for Identification, so make sure you give the correct details and an Active email address.

Follow the link in the Email to verify your Identity. Here make sure that you have a valid residence permit. You will also provide your signature digitally. All of this can be done within just 2 minutes.

Once the signup process is completed Advanzia will process your application.

Does Advanzia Credit Card check SCHUFA?

A few years ago, there was no credit history check, but now they do one. However, as long as you don’t have any negative entries in your SCHUFA, you don’t need to worry about being rejected.

Once your application is accepted, Advanzia will post your Free Credit Card to the Address you provide during registration.

You will receive your Mastercard Gold after approximately 2-3 weeks. For security purposes the pin will be sent separately. If you do not receive the Credit Card and Pin by 3 weeks you should let Advanzia know using the contact form in the Advanzia app or the customer portal so that the can rectify the situation.

Thats it. This is the whole registration process.

Advanzia Credit Card Limit

At this point, you can use the Free Mastercard Gold within your personal credit limit. You can check your credit limit using the Advanzia App. This app is necessary for you to use your Free Mastercard gold credit card.

Increase Advanzia Credit Limit

The credit limit can be a little lower at the beginning because Advanzia bank does not have a customer relationship with you. As a new customer they need to know your payment behavior first. Your credit limit can be increased after just a few months of regular incoming payments.

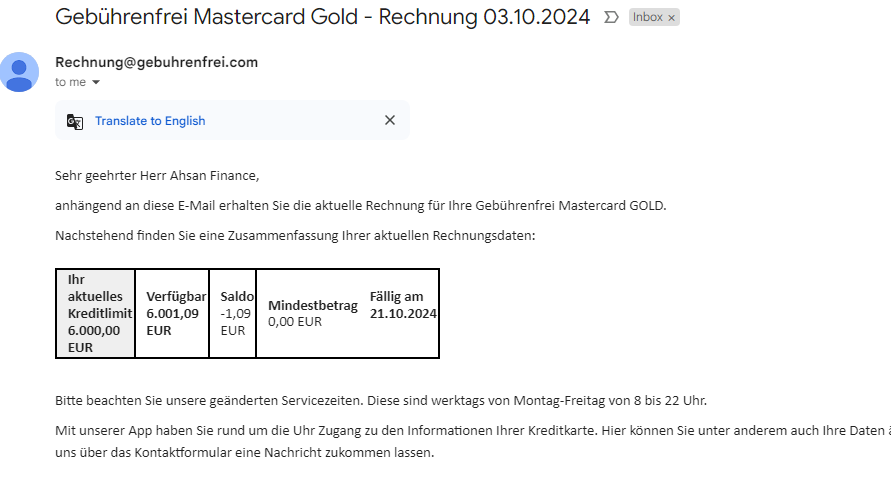

My credit limit when I got this credit card was 100€ , after a couple of months the credit limit was increased to 1000€ , it stayed there for a year or so as I never used it for more than 5 to 6 hundred Euro per year. But later on with a higher usage my Credit limit increased to 6000€.

So the best way to increase the limit of Advanzia Credit Card is to use it regularly and pay off the invoice.

Now honestly speaking I have never used more than 3000€ in a single month using this credit card. Perhaps if I completely used the 6000€, my credit limit might get increased but I don’t plan to test this theory any time soon.

Advanzia Gebührenfrei – Billing cycle and Deadline

Some people forget that this is a credit card and this doesn’t give you free money. To use this credit card properly you need to understand the billing cycle.

Advanzia Credit Card Billing Cycle

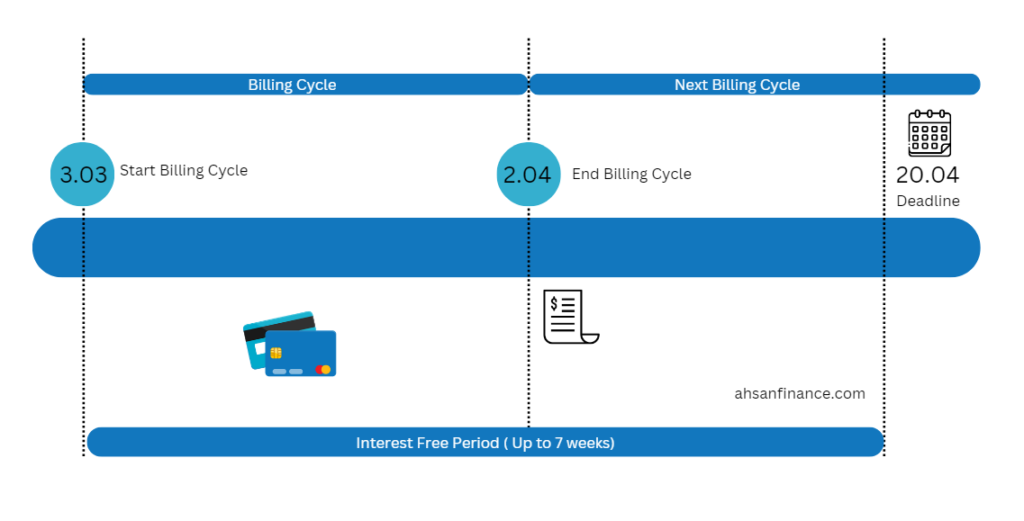

The billing cycle of Advanzia Mastercard Gold credit card starts from 3rd of each month and ends the 2nd of the next month, and the deadline to pay each billing cycle month is the 20th of next month.

For example, the billing cycle for October starts on 3. October till 2nd November. The credit card statement is sent by email on the 3 November, and the deadline for payment would be 20th November.

Advanzia Credit Card Interest Free Period

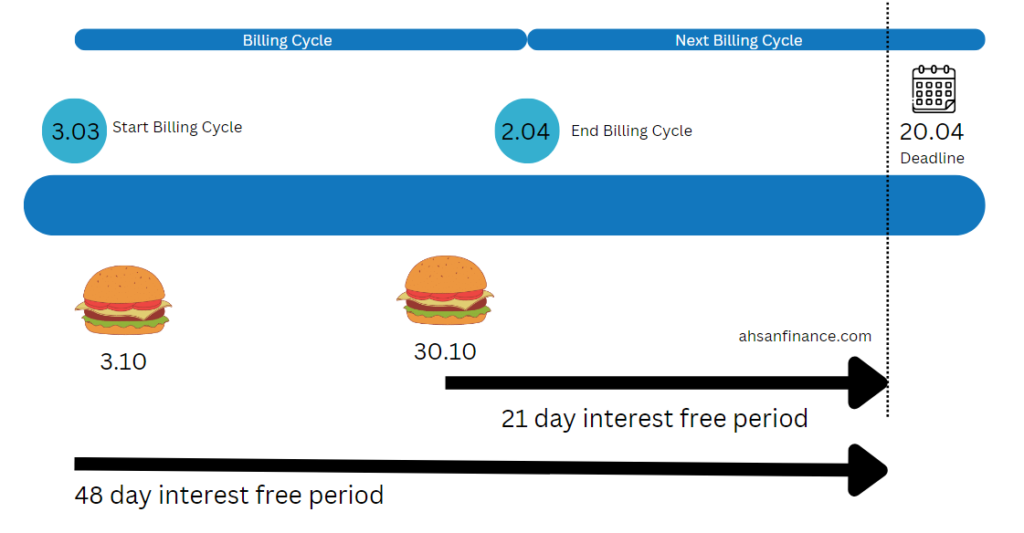

Between the billing cycle and the deadline day you can have an interest free payment. For example if you used your credit card to buy something on 30th October, this purchase will be in the October billing cycle and you will have until 20th November to repay this amount without paying an interest on it.

So depending on when you make your card purchase, you will have between 20 days and 47 days interest-free period to make the payment

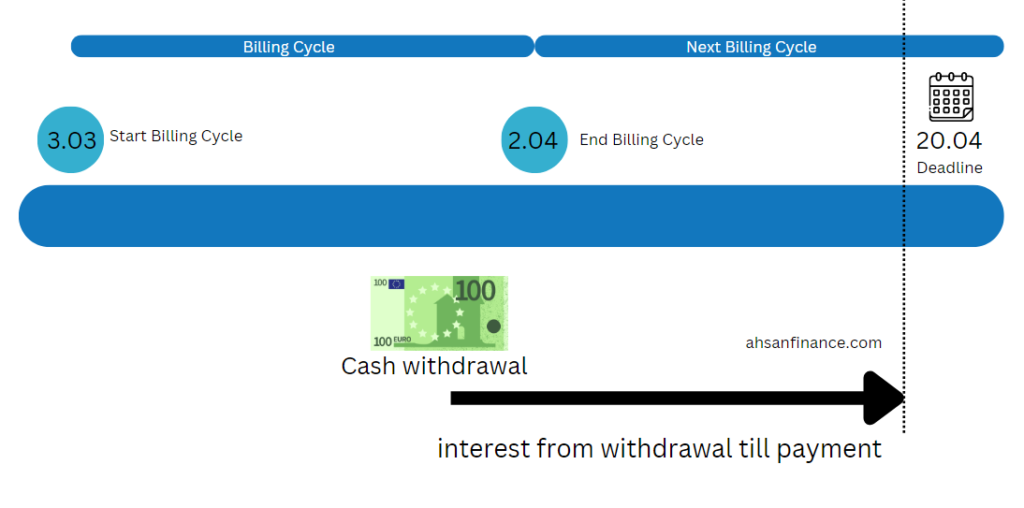

Cash withdrawal with Gebührenfrei

You can withdraw Cash with your Gebührenfrei Credit card but Cash Withdrawals using Advanzia Mastercard Gold are treated differently. Here interest on cash withdrawal using credit cards are due immediately. So, the interest on cash withdrawal will be applicable from the first day.

In addition to cash withdrawal, you can also use this Free Credit Card in Germany to transfer funds from the Credit Card to your bank account.

This can be done through bank transfer option in the app. The transfer limit for regular bank transfer will be again based on your credit limit. Similar to cash withdrawal, bank credit transfer will also incur interest from the second you make the transfer.

Advanzia Free Credit Card invoice

Now As I mentioned earlier On the 3rd of Each month you will get an email similar to this one

You will also get a invoice as well in the attachement. This will have details with you can use to pay pay your credit card bill using manual bank transfer.

Each month, you must take the initiative to transfer funds from your bank account to your Advanzia Credit Card account. This is not done automatically, so be sure to transfer the funds on time.

To ensure no interest charges are incurred, make the transfer online at least two business days prior to the due date.

With every invoice, you’ll see a minimum payment amount listed. This amount depends on how much of your credit limit you’ve used. The minimum is the least you have to pay, but if you don’t pay the rest, interest will start to add up.

I always make sure to pay the full amount at least a week before the due date, and ideally, I pay on the same day I get the invoice. This way, I don’t have to pay any interest on my credit card usage.

Gebührenfrei Credit Card Interest Rate

The interest rate of the Advanzia Gebührenfrei Credit Card is 24.69% per year. This interest applies if you don’t pay your invoice in full. For cash withdrawals and bank transfers, interest starts right away. There is no interest-free period for these transactions.

Gebührenfrei Interest Calculations

Let’s do some interest calculations. To find out approximately how much interest you’ll be charged, you can use this formula:

(balance x interest rate x number of days) / 365

For example, if your balance is €1,000 and you carry it for 30 days over the interest free period , the interest would be:

(€1,000 x 24.69% x 30) / 365 = €20.30

So, you’d have to pay €20.30 in interest for carrying a €1,000 balance for 30 days after the due date.

Credit Card Features

With the Advanzia Mastercard Gold Credit Card, cash withdrawals are free at ATMs with the Mastercard logo. But sometimes, the bank’s ATM may charge a small fee for using a foreign card. This fee is usually between €2 to €5 per transaction.

The bank’s ATMs must inform you about this fee before you withdraw cash, and you must agree to it. If you don’t agree, the transaction won’t happen. If you notice a fee, it’s a good idea to try another bank’s ATM. Also, avoid using generic ATMs you find all over Europe.

They charge very high fees! Personally, I don’t use this card for cash withdrawals, as there are better ways to handle cash. Let me know in the comments if you want me to make a video about that.

Free Insurances with Gebührenfrei Credit Card

Besides free cash withdrawals, you also get free travel insurance. If you pay at least 50% of your travel costs with an approved transport company using the Free Mastercard Gold, you, and up to 3 passengers, are insured for trips lasting 2 to 90 days.

You also get:

- Travel liability insurance: up to €350,000 per incident

- Health insurance for trips abroad: up to €1,000,000, including dental coverage

- Travel accident insurance: €40,000

- Travel cancellation insurance: 20% excess, with a minimum of €100

- Baggage insurance: €2,500 for one person, with a total limit of €3,000 when traveling with others

- Transport accident insurance

- Some restrictions apply so make sure you read the insurance details provided in the advanzia app

Advanzia Contact Details

You can ask questions about travel insurance at this number +32 (0) 2 897 2853, or request forms for reporting damage.

In case of medical emergencies during your trip, you can contact + 44 203 582 9736. (available 24/7).

Make sure to checkout the FAQ page for the up to date info on the insurance and contact details.

Another great perk with the Gebührenfrei credit card is a 5% discount on rental cars. To get this discount, go to advanzia rental Car. Book your rental car, and 5% of the rental value will be credited to your card one month after you return the car. Just remember, canceled bookings and withdrawals don’t qualify for this refund.

Advanzia Bad Experience

My experience with this card has been great, but many people complain about customer service. Maybe I’m used to waiting on hold for a while, but others say the support takes too long and that the staff doesn’t understand their problems well. Some even mention the staff has a strong accent. As a foreigner, I did notice an accent, but it wasn’t so strong that I couldn’t understand them.

There’s also a foreign transaction fee. If you use this credit card to buy something in a foreign currency, you’ll be charged a fee of 1.5% of the transaction amount.

The advanzia gebuhrenfrei credit card is just one of the Free credit cards available in Germany, in this guide I compare it with 5 other Free Credit Cards in Germany.

Disclaimer: None of the content in this article is meant to be considered as legal, tax or investment advice, as I am not a financial expert or a lawyer and am only sharing my experience with stock investing. The information is based on my own research and is only accurate at the time of posting this article but may not be accurate at the time you are reading it.