Let’s face it—when you first get your Advanzia Mastercard Gold, the starting credit limit feels… modest. Sometimes insultingly modest. You might be thinking, “How am I supposed to book a flight or rent a car with the Advanzia Credit Card on a €100 limit?” and you wonder how to increase your Advanzia Credit Card Limit?

You’re not alone. This is one of the most common gripes among new cardholders, especially expats who don’t yet have deep roots in Germany’s credit system. But here’s the thing: Advanzia will increase your limit—if you play their game right.

So, how do you go from a starter limit to something actually useful? Let’s walk through it.

Is it possible to increase Advanzia Credit Limit?

First Things First: Why Is Advanzia Credit Limit So Low?

Advanzia operates a little differently from your standard bank-issued credit card. For starters, they don’t run a full-on credit check when you apply. That’s why it’s so easy to get one, even without a perfect Schufa score.

The trade-off? They treat everyone like a potential risk at first. So, your credit limit is their way of saying: “Show me I can trust you.”

The Golden Rule: Prove You’re Not a Financial Wild Card

It might sound obvious, but this is the heart of it: use the card responsibly.

Here’s what that looks like in practice:

- Use the card regularly. Monthly activity signals to Advanzia that you’re serious, not just hoarding the card for emergencies.

- Always pay in full. Don’t wait for reminders. Set up calendar alerts. Better yet, pay it off as soon as the invoice drops.

- Avoid late payments like the plague. Seriously. One missed payment can delay any future limit increases by months.

- Start small. Try using the card for groceries, subscriptions, or your monthly train pass. Then gradually increase the spending.

Think of it like building a reputation at your new favorite café: the more often you come in, tip well, and don’t cause trouble, the better the service gets.

So, When does Advanzia Increase the Credit Limit?

There’s no exact formula, but here’s the general rhythm:

- After 2–3 months of timely payments, you might see a small increase.

- At the 6-month mark, if you’ve been squeaky clean, you’re more likely to be bumped up significantly.

- After a year, some users report having limits over €3,000 or even €5,000—especially if your income and spending habits justify it. My maximum limit with this card is about €6,800.

But keep this in mind: it won’t happen automatically. You’ll usually need to ask.

Related Guide: Advanzia Credit Card in Germany (My 9+ Year Review)

How to Request a Advanzia Credit Limit Increase

Here’s how to handle the request smoothly:

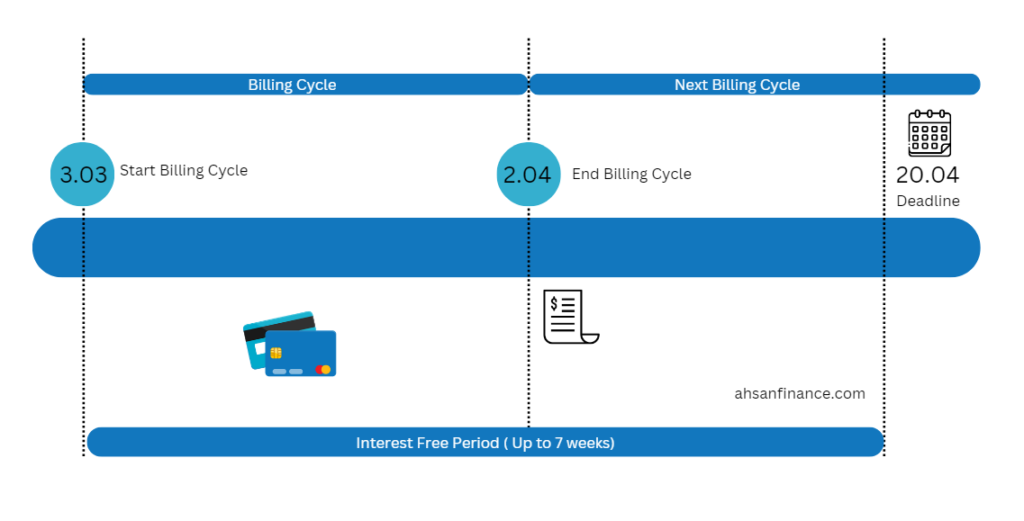

- Wait at least 3 billing cycles. Any sooner, and they’ll likely ignore you.

- Send an email to customer support at service@advanzia.com. Include:

- Your full name

- Your customer number

- A short, polite request (e.g., “I’d like to request a credit limit increase, as I’ve been using the card regularly and paying on time.”)

- A recent proof of income (a payslip or freelance invoice will do)

Optional: You can add a short note explaining why you need the increase. Keep it simple and professional—no novels.

And yes, they usually take their time to respond. I would also write the email in German and not in English. Also there are no guarantees if they would respond to the email or increase your Advanzia Credit Card Limit.

Can I Game the System?

Not really. There’s no “hack” to force Advanzia to raise your limit overnight.

Some people think using the full limit and repaying immediately will speed things up. In reality, it might just look like you’re constantly maxing out your card not a great signal.

Instead, focus on showing consistency: steady usage, full payments, and good communication if something goes wrong.

Other Tricks That Might Help (or Hurt)

Let me throw in a few extras that tend to come up:

- Don’t pay late, ever. I know I said this already, but it’s worth repeating. Even one late payment can kill your chances of an increase for months.

- Keep your Schufa clean. Advanzia doesn’t do hard pulls, but they may check your general standing if you request a big increase.

- Use their app. It’s not pretty, but it works. Logging in regularly might show engagement (I have no proof if this works but you need the app anyway so it won’t hurt installing it).

One Last Thing: Do You Even Need a Higher Limit?

This might sound strange coming from someone writing a guide on how to increase your Advanzia credit limit but ask yourself: why do you need more credit?

If it’s for travel flexibility or a security deposit on a rental car, fair enough. But if you’re using the card to cover day-to-day expenses because you’re short on cash… that’s a red flag. A higher limit won’t fix deeper budget issues it might just mask them.

Wrapping Up: Play the Long Game

Advanzia isn’t trying to be fancy. They just want to see that you’re reliable. And once you’ve shown that month after month they’ll trust you with a higher limit.

So don’t stress if you’re stuck with a €300 cap for now. Keep using it, keep paying it off, and eventually, they’ll loosen the reins.

With a little patience and the right habits, increasing your Advanzia credit limit can be a smooth ride. I recommend you read my complete guide on Advanzia Credit Card to get a better idea about it.

Disclaimer: None of the content in this article is meant to be considered as legal, tax or investment advice, as I am not a financial expert or a lawyer and am only sharing my experience with stock investing. The information is based on my own research and is only accurate at the time of posting this article but may not be accurate at the time you are reading it.