Imagine earning an extra €600 every single month in Germany without paying taxes, and without paying into social security. Sounds too good to be true? Well, it isn’t. It’s 100% legal, and it’s called a Minijob in Germany.

In this guide I’ll explain exactly how Mini Jobs work, who qualifies, what the rules are, and how you can use them to boost your income: whether you’re a student, already working full-time, or just looking for a simple side hustle.

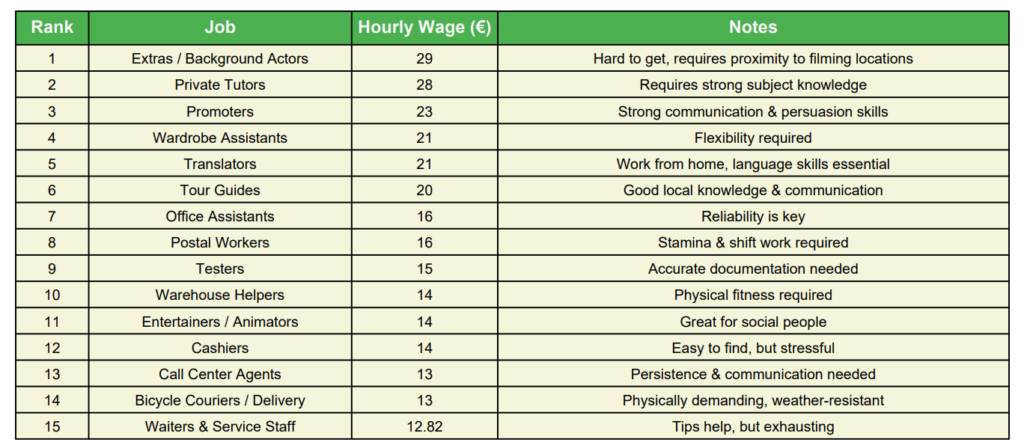

I’ll also share some of the highest-paying mini jobs in Germany that can earn you the maximum amount with only a few hours of work each month.

What is a Minijob in Germany?

Let’s begin by understanding the basics.

A minijob in Germany is basically a legal hack to earn money in Germany without paying a single cent in taxes or social contributions. Sounds good, right? But there’s a catch and I’ll explain that in a moment.

But the monthly earnings cap for mini jobs is tied to the minimum wage in Germany. This cap has changed over the years. In 2024, the maximum you could earn in a mini job was 538 euros per month. In 2025, that amount increased to 556 euros per month. And in 2026, it’s further increased to 603 euros per month. That’s a yearly earning of up to 7.236 euros without triggering taxes or social insurance payments.

But mini jobs aren’t just about earning tax-free income. They are also regulated to ensure workers receive fair treatment. That includes rights such as paid sick leave, holiday entitlement, and minimum wage protections.

Who can do a Minijob in Germany?

Now you might be wondering: ‘Wait, does this even apply to me?’ The answer is almost always yes. Whether you’re a student, already working full-time, or even between jobs, there’s a version of a mini job that fits your situation

The mini job system is designed to be flexible and inclusive. But that flexibility comes with certain rules that must be followed to avoid penalties.

Types of Minijobs

Now, you might immediately think of waitressing, cashier jobs, or working in retail when you hear the term “mini job.” And yes, these are very common examples. These fall under what are called commercial mini jobs, where the employer is a company or business. You could be working in a :

- Café

- Restaurant

- Supermarket

- Logistics warehouse

But there’s also another category known as household mini jobs. These are jobs where the employer is a private individual rather than a company. Typical household mini jobs include:

- Babysitting

- Dog walking

- Tutoring

- Gardening

- Cleaning

Now let’s look at the two types of mini jobs more formally defined under German law.

Marginally paid employment

First, there’s the regular mini job, where the average monthly income does not exceed the income threshold. For 2026, that’s 603 euros per month. Over 12 months, the maximum you can earn is 7.236 euros.

However, there is a legal exception that allows you to exceed this amount for up to two months per year. This means that under specific conditions, your total annual income from a mini job can reach up to 8442 euros.

These exceptions apply when, for example, you work additional hours in one month due to seasonal demand but still average under the yearly limit.

Seasonal work or vacation jobs

The second type is called short-term employment. This is different because it’s not about how much you earn, but how long you work. In a short-term mini job, you can earn any amount of money.

But you can’t work for more than three months or 70 working days in a calendar year. The key point is that this type of employment must be temporary and not ongoing. So this could work well if you’re helping out during holiday seasons or working at an event.

Earning above the Minijob threshold?

But what happens if you go beyond the earning limit or the permitted duration?

In that case, your job is no longer considered a mini job. Instead, it becomes a regular taxable employment. You and your employer will both be responsible for social contributions, and the job must be reported to the health insurance provider.

This can also affect your tax class and take a significant chunk out of your earnings. So always track your income and working hours carefully.

Can you do a Minijob if you already have a Full-Time Job?

Now, an important point that many people overlook: if you already have a full-time job, you need to inform your employer before starting a mini job.

In most cases, employers are fine with it. But there are situations where your employer can object. For example, if your mini job is with a competitor or if it conflicts with your working hours or duties. German labor law also requires that you adhere to working hour limits, even if you’re combining multiple jobs.

Here’s where most people get into trouble. German law is super strict about working hours. If you break these rules, your boss can legally stop your mini job.

So listen carefully: You can’t work more than 48 hours a week in total, and you need 11 hours of rest between shifts. Translation? If you finish your full-time job at 7 p.m., you can’t start your side hustle until 6 a.m. the next day. Tough, but that’s the law.

Doing a Minijob on Sundays

Sundays in Germany are generally considered days of rest. Working on Sundays is usually prohibited unless you work in specific sectors like healthcare, public transport, gastronomy, or entertainment. Even then, if you do a minijob in Germany on a Sunday, you are required to take another day off as compensation.

And if you already work Monday through Friday at your full-time job, working Sundays in your mini job could violate rest laws, which can lead to warnings or even dismissal.

If your employment contract includes a clause on secondary employment, be sure to read it carefully. Some contracts require prior written approval, while others only require notification. When in doubt, it’s a good idea to consult a lawyer. You can find affordable legal insurance providers in Germany in the vide description that can help you navigate employment issues.

How to Inform Employer about Minijob in Germany?

So how do you notify your full-time job employer that you have started a minijob?

You can download a simple template to help you inform your employer about your minijob in Germany

Related Guide: Free Minijob Template Download

Just sign it and send it in writing, either via email or letterfor documentation. This ensures there’s no confusion later, especially if your employer’s policies change or if you change your mini job role.

Okay, before we jump into the highest-paying mini jobs, let me quickly bust some of the most common myths.

Do you get holiday leave in a minijob?

The answer is yes. Mini job workers have the same right to holiday leave as full-time employees. The number of days depends on how many days you work per week.

For example, if you work only on Mondays and Wednesdays, you are entitled to vacation days proportionate to that schedule. Employers cannot ask you to take leave on days you wouldn’t normally work.

Also, if there is a public holidays on your working day, you do not have to make up for those missing hours.

Do you get sick leave in a Minijob in Germany?

If you’re sick, you must notify your employer before your shift starts and let them know how long you expect to be ill.

In some cases, depending on your contract, your employer might ask for a doctors certificate from the first day.

If you’ve been employed for over four weeks, you’re entitled to continued payment for up to six weeks. And no, you don’t have to make up those missed days.

Can you have more than one minijobs at a time in Germany?

Technically yes, but you must ensure that your total income from all mini jobs does not exceed the monthly limit.

If you cross the 603-euro limit in 2026 (2025: 556 Euro), all of your income becomes subject to tax and social contributions. You might also be placed under Tax Class 6, which has higher deductions.

So while you can combine jobs, the total income must remain within the legal limits.

What are the best paying minijobs in Germany?

Alright, here’s the part you’ve probably been waiting for, the jobs that actually pay more than minimum wage. Because yes, some mini jobs pay double, even triple the average rate.

Now most mini jobs pay around the statutory minimum wage, which is 12.82 euros per hour in 2025 and set to rise to 13.90 euros in 2026. To earn the full monthly limit , you’d have to work about 43 to 45 hours a month.

But there are mini jobs that pay significantly more than the minimum wage. For example:

- Storage helpers can earn between 15 and 18 euros per hour

- Life Guards may earn about 18 to 20 euros per hour

- Mystery shoppers often make around 24 euros per hour

- Private tutors can earn as much as 28 euros per hour

That means, as a tutor, you only need to work about 20 hours a month to reach the maximum mini job limit. These high-paying roles are great if you want to work fewer hours while maximizing your income.

Of course, 600 euros a month might be enough for some people, but others may want to earn more.

So here’s something for you to consider what if you could earn more than 600 euros per month by starting your own business on the side, even while working full time?

Yes, it’s absolutely legal, you can read my complete guide where I explain exactly how to set up a small business in Germany, even with a full-time job.

Disclaimer: None of the content in this article is meant to be considered as legal, tax or investment advice, as I am not a financial expert or a lawyer and am only sharing my experience with stock investing. The information is based on my own research and is only accurate at the time of posting this article but may not be accurate at the time you are reading it.