Today we are going to look into Net Worth in Germany by Age: to help you see Where Do You Stand? Because the truth is, most of us wonder. Am I closer to the 25-year-old with just €15,000 in net worth or the 60-year-old retiree with a Net Worth of €300,000 in Germany?

But the wealth story in Germany isn’t just about age. When you add in factors like immigration background, location, and income levels, the picture gets even more surprising.

Thats why in this guide, I’ll break down the numbers, reveal who’s actually wealthier, and show you what this means for your own path to financial freedom in Germany.

Net Worth in Germany by Age

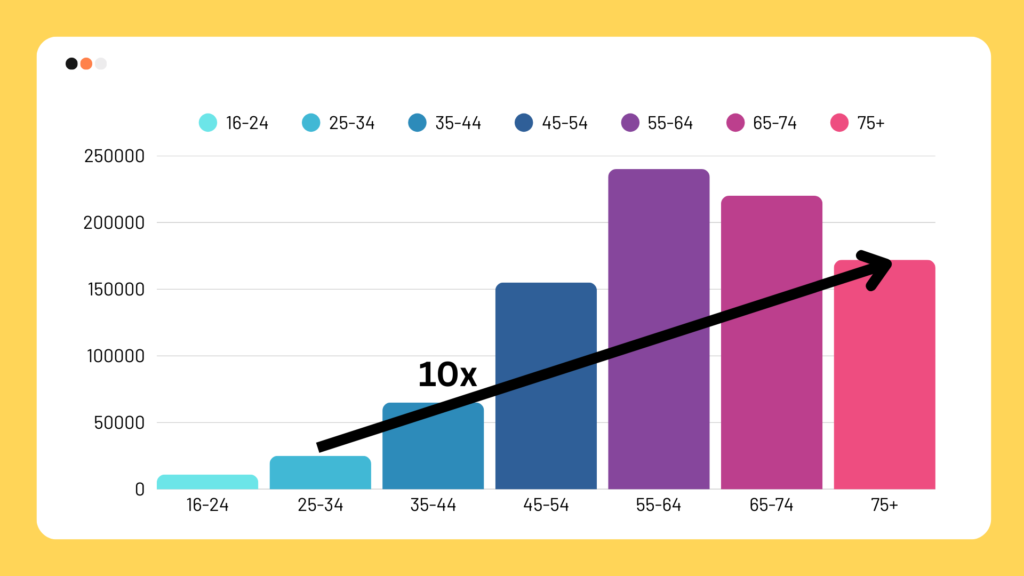

Across Germany, wealth grows with age. That might sound obvious, the longer you live, the more time you’ve had to earn and save. But the scale of the difference is shocking.

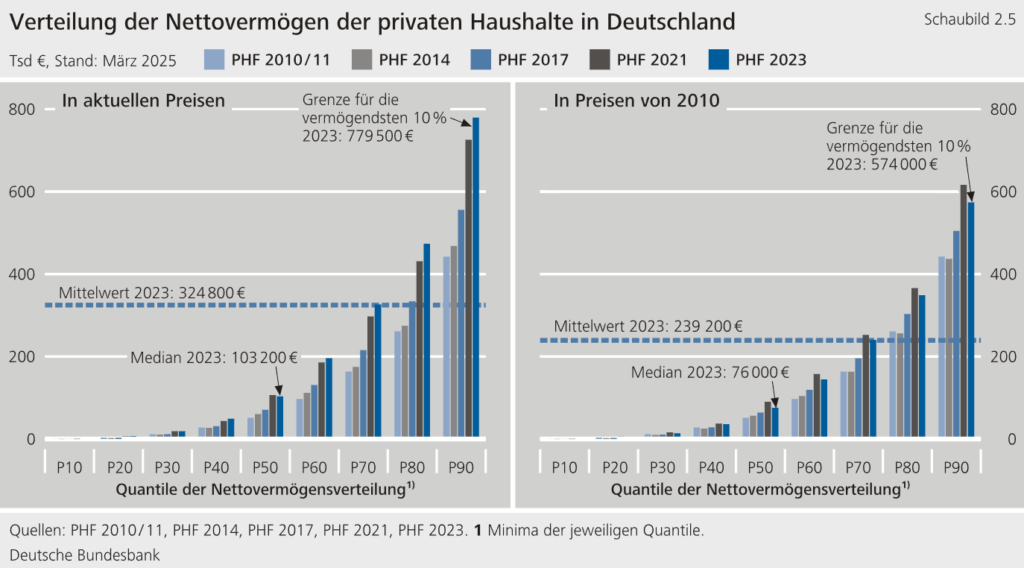

Recent Bundesbank data shows the average household has around €325,000 in assets. But averages hide the truth. If you’re under 25, the typical net worth is just €11,000. In your 30s, you’re still in the “tens of thousands.” But then something dramatic happens: by your 50s, the median household is sitting at €240,000. That’s more than ten times what the under-35 crowd has.

Why does this explosion happen in the 50s? What suddenly turns middle-aged Germans into the wealthiest group?

Ill share the reason in a moment. But first, let’s see how this life cycle unfolds.

Related Guide: How to Buy Stocks in Germany : Expat Guide

Why are people aged between 55 to 64 with highest Net worth in Germany?

Picture your financial journey like climbing a hill. In your 20s and 30s, you’re carrying a backpack full of debt, low wages, and high living costs. Progress feels slow. But in your 40s and 50s, you start moving faster: your salary rises, you may buy a home, and your savings finally begin compounding.

By the time you hit 55–64, most Germans have paid off mortgages, built pensions, and own significant assets. That’s why this group is at the peak: they are the richest Germans by far.

Now, here’s the problem wealth then declines in old age. Once you reach your late 60s and 70s, savings get drawn down. Yet even then, the elderly are much wealthier than young adults. A 75-year-old today has on average €172,000 , still ten times more than many 30-year-olds.

So the curve is clear: young → poor, middle-aged → rich, retirees → slightly less rich.

The winners are those who manage to get property and investments in their prime working years.

Wealth Difference of Immigrant families in Germany

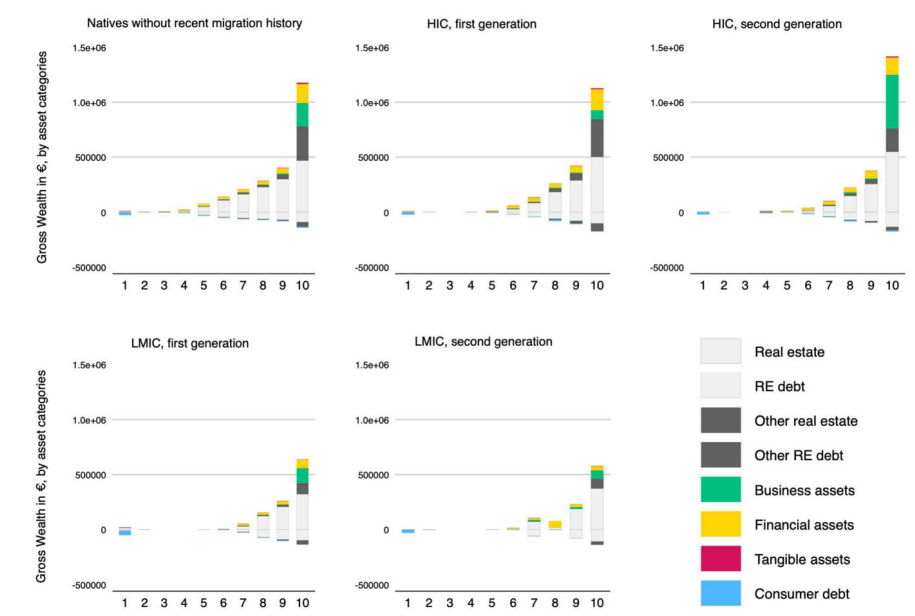

And that brings us to the next question: what happens if you’re not starting at the same line? What if you move to Germany in your 20s or 30s, without family assets or inherited wealth?

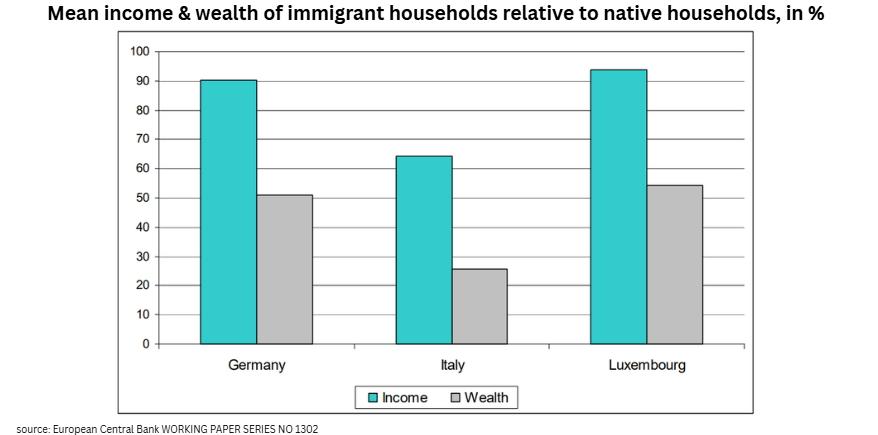

Here’s where it gets really interesting. Germany has millions of people with migration backgrounds. And the wealth numbers for these households look very different.

Studies show that immigrant families have about half the wealth of native Germans. If the typical German has €100,000, the average immigrant has closer to €50,000. In some cases, the gap is even wider.

Why is the Net Wealth of Native Germans Higher than Immigrants?

So why does this gap exist, and is it permanent?

There isn’t one single reason. Instead, it’s a mix of structural factors:

Imagine two families in Germany. Both are 40 years old, both working hard, both raising kids.

The first family has been here for generations. Over the years, they bought a home, built up pensions, and invested a little. By 40, they’ve got some equity, some savings, and maybe even a portfolio.

Now picture the second family. They arrived in Germany in their early 30s. Starting fresh meant no decades of savings to fall back on. Maybe their degrees took years to get recognized, so they started out in lower-paying jobs. They’re still renting and remember, renters in Germany have a median wealth of just €18,000, while homeowners sit around €450,000. Add to that the habit of keeping cash or sending money abroad instead of investing, and it’s easy to see why even with a solid income, they’re still building slowly.

By age 40, the first family might be €50,000 to €100,000 ahead. Not because they work harder, but because structural factors time in the country, income levels, housing, and investing habits make a huge difference in how wealth builds over decades.

Related Guide: Best Investing Apps and Brokers in Germany (for Expats)

How children of Immigrant parents are thriving in Germany

Now here’s the interesting part: when researchers control for age, education, and income, the migrant wealth gap shrinks dramatically. Meaning, the system isn’t punishing immigrants for being immigrants. It’s about starting later, earning less early on, and not owning property.

So migrants are poorer mainly because of structural disadvantages, not personal failings.

But will second-generation migrants, the kids of immigrants finally catch up? Or will this gap persist into the future?

There’s some good news here. Children of migrants born in Germany are doing better than their parents. They’re more likely to get higher education, enter skilled jobs, and build wealth. The catch? Homeownership rates are still much lower, which keeps the wealth gap alive.

Even migrants from wealthier countries only have about 75% of the wealth of natives. Migrants from poorer countries? Sometimes as little as one-third. So while progress is happening, the “catching up” is slow.

Important Factors for Expats who want to Increase their Net Worth in Germany

All of this leaves us with an important question: what does all of this mean for you if you’re trying to build wealth in Germany?

Well, in Germany, your wealth is mostly determined by age and homeownership. If you’re young, you’re almost certainly poor compared to older groups. That’s not a personal failure it’s the system.

But if you’re also a migrant, you may be starting from even further behind. The challenge is bigger, but not impossible. There are things you can do to reduce the gap, like:

- Focus on stable income growth early.

- Consider property ownership as a long-term wealth engine.

- Start investing, even small amounts in appreciating assets.

- Be aware that comparisons to 50- and 60-year-olds are unfair. You’re not competing with them; you’re just at a different stage of the curve.

Related Guide: How I would Start Investing as a Foreigner in Germany

Its not a Fair Game but you might still have time

Yes, Germans in their 50s and 60s hold the most wealth mostly thanks to property ownership and decades of compounding.

Migrant families, on average, still lag behind, but their second generation is closing the gap. And if there’s one thing the numbers prove, it’s this: age and being German-born are the strongest predictors of wealth in this country.

But these averages are not your destiny. Your personal net worth doesn’t have to look like the typical curve. If you start building wealth earlier, invest consistently, and take steps like buying property when it makes sense, you can actually flip the script and land ahead of the averages.

So when you ask: Where do I stand compared to others my age in Germany? the real question is: where do you want to stand five, ten, or twenty years from now?

Because the gap isn’t permanent. And if you understand the rules of the game, you can absolutely change your position on that chart. The first step is to start investing as an Expat in Germany!

Disclaimer: None of the content in this article is meant to be considered as legal, tax or investment advice, as I am not a financial expert or a lawyer and am only sharing my experience with stock investing. The information is based on my own research and is only accurate at the time of posting this article but may not be accurate at the time you are reading it.