Schufa in Germany is your Credit Score. Thinking of getting a bank account, credit card, or even a loan in Germany? Perhaps you are getting rejections from Credit Card Providers, Banks, or even Home loans.

Well, there’s one thing that can make or break your chances—your Schufa score. But what exactly is Schufa? How does it affect your financial life in Germany? And how can you check or improve your credit score in Germany?

In this Guide, I’ll share every thing you need to Know about SCHUFA in Germany

What is Schufa in Germany?

Credit Score in Germany (SCHUFA)

Unlike the United States, where the most common FICO Credit Score ranges from 300 to 850. Germany uses a credit scoring system called the SCHUFA score, which ranges from 0 to 100.

Both scoring systems consider factors such as payment history, credit utilization, and length of credit history, but they weigh these factors differently.

Additionally, the information used to calculate credit scores differs between the two countries. For example, in the United States, rent payments and utility bills may be reported to credit bureaus and considered in credit scoring models. This is not typically the case in Germany unless your landlord files formal charges against you for non payment.

What Exactly is this SCHUFA?

Well SCHUFA stands for “Schutzgemeinschaft für allgemeine Kreditsicherung” . But whats important is that SCHUFA Holding is a company that collects information about you as a consumer from various sources.

These sources include utility suppliers, banks, and internet providers. They keep track of your bills and fines over time and use this data, along with their own algorithm, to create a credit score for all German residents.

When people talk about “SCHUFA”, they’re referring to the record that the company holds about their creditworthiness in Germany.

This company rates your ability to pay bills and creates a record called SCHUFA Auskunft that will follow you in your everyday life as a consumer. It’s important to keep this record clean, or there could be serious consequences.

SCHUFA receives data from almost every company in Germany, including about 10,000 cooperating partners in various industries such as finance, insurance, telecommunications, and retail. Your SCHUFA record is created as soon as you register an Address in Germany.

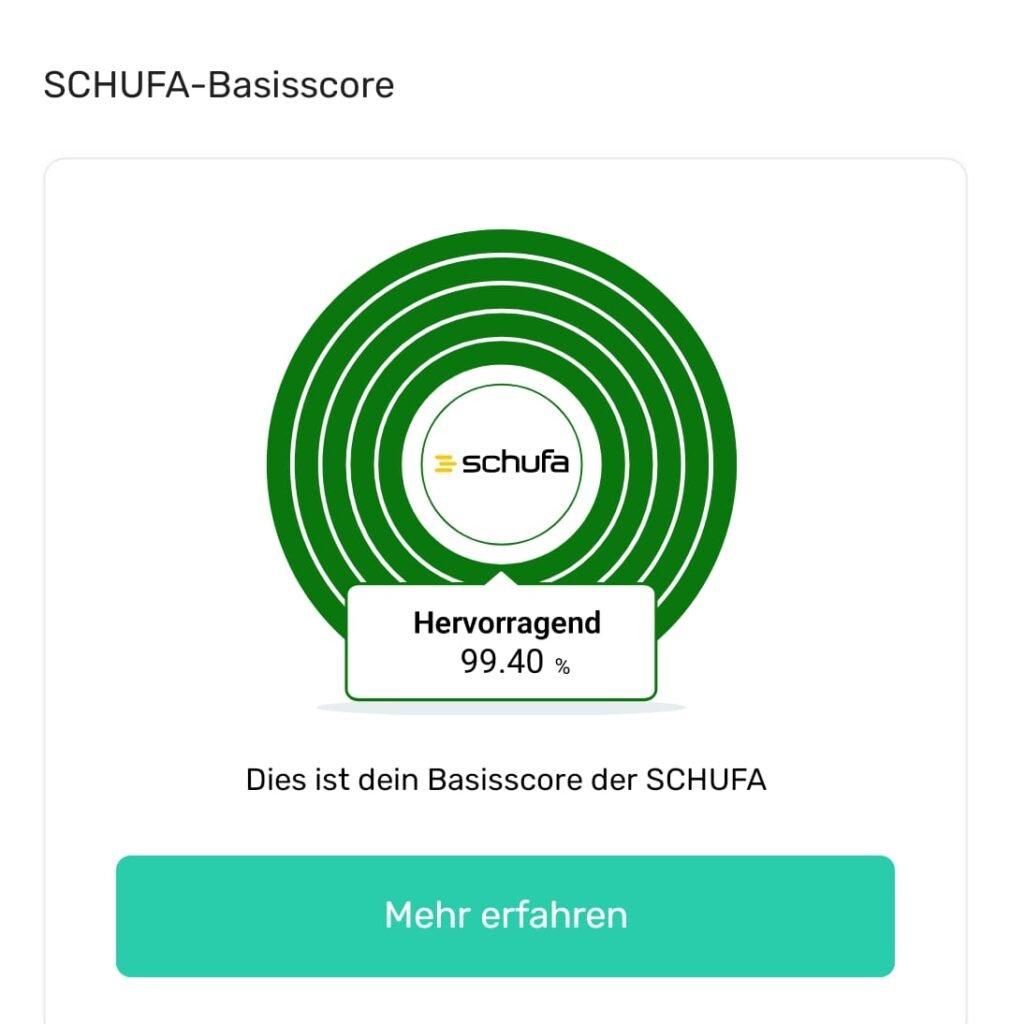

Schufa Basisscore and its meaning

Your initial SCHUFA score, called the “Basisscore,” starts at 100%, in theory. However, if you fail to pay your bills, your score will decrease proportionally. If you are getting value from this video please hit the like button and consider subscribing!

This score predicts the likelihood that you will pay your bills, loans, and fulfill other contractual obligations.

| Score value | Risk assessment – Level of risk |

|---|---|

| > 97,5 % | Very low |

| 95 % – 97,5 % | Low to negligible |

| 90 % – 95 % | Satisfactory to elevated |

| 80 % – 90 % | Fairly elevated |

| 50 % – 80 % | Very elevated |

| < 50 % | Critical |

What is a good Schufa Score

Having 97% Schufa Score is Very good and 95% Credit Score is considered good. However, the system is designed to prevent you from becoming overwhelmed by debt over time.

So Even if you pay all your debts, your score may still drop a few percentage points for unknown reasons. So It’s totally okay to have a score as low as 95%. If your score is less than that, you should take a look into getting a paid version which provides further details

Please note that it is not possible to achieve a 100% score on the SCHUFA rating system.Most people with amazing scores remain around 97.5%.

This small reduction in score is due to the possibility of unexpected events, such as death, which can impact your ability to pay debts. However, this is not necessarily a bad thing, as SCHUFA’s primary purpose is to protect against credit risks.

The highest Schufa score that I ever had was 99.4% and right now my score is at 98.19%

How to check Your SCHUFA in Germany?

Now, As a German resident, you have the legal right to receive one free SCHUFA record per year to see what data has been stored in the report. To request it, visit the official website and look for the section called Datenkopie (data copy). Click on “Jetzt beantragen” to start the process.

On the next page you have to give your personal information and current registered address. You can also provide additional information like any additional registered addresses and previous residential details.

To make the process simpler, you MAY provide your German ID document, Your Passport and Your City registration certificate as well.

After requesting your free SCHUFA report, you’ll receive it via mail within a few days.

Get instant Access to Schufa Score

The second and the quickest option to check your Schufa Basisscore or Credit Score in Germany is using the Bonify app. You can download the bonify app for free.

You will have to provide your ID document to proceed but once you have added all your details, you now get instant access to your Schufa Basisscore.

As you can see here my current score is 98.19 , it was 99.4% a couple of months ago and has dropped probably because I moved houses in the past 6 months and opened an additional bank account. But I do not have any negative entries thats why my score is till quite high.

Please note that When renting an apartment, many landlords require a paid version of your SCHUFA report along with an official certificate that provides a comprehensive view of your creditworthiness in Germany.

A Very Important thing to note is that your SCHUFA report is only for Germany. So it doesnt matter what Credit Score you might have in the US or any other country you are coming from!

To order a detailed report, called SCHUFA-BonitätsAuskunft (which translates to “creditworthiness report”), visit the official website or order it using the Bonify app.

The report costs 29.95 euros and will also be sent to you via mail within a few days or instantly via email. The Paid SCHUFA Mieterauskunft Report looks something like this

How to Improve Schufa Score?

So you got your SCHUFA report and your score is not great! What can you do to Improve your Credit Score in Germany.

Here are a few things you can do to improve your SCHUFA Score

- Pay your bills on time One of the most important factors affecting your SCHUFA score is your payment history. Late or missed payments can have a negative impact on your score, so it is important to pay your bills on time. Set up automatic payments or reminders to help you stay on top of your bills.

- Close unused credit cards Having too many credit cards can also negatively impact your SCHUFA score. If you have credit cards you no longer use, consider closing them. This will help reduce your credit utilization, which is another important factor in calculating your credit score.

- Keep credit utilization low Your credit utilization is the amount of credit you use compared to the amount of credit you have available. A high credit utilization can negatively impact your SCHUFA score, so it is important to keep it low. Try to use no more than 30% of your available credit at any given time.

- Never use the Over drafting option. Many banks offer over drafting at very high interest rates. But using this option has quite a negative effect on your credit score. So if possible, never use that option!

- Monitor credit reports regularly It is important to monitor your credit reports regularly to ensure they are accurate and up-to-date. Errors on your credit report can negatively impact your SCHUFA score, so it is important to correct any inaccuracies.

Remove Negative Entries from Schufa

If you have a negative entry. The only thing you can do is try to resolve the cause of that negative entry as soon as possible.

For example, the most common things negatively affecting your Credit Score in Germany are unpaid bills from a telecom contract and Unpaid Gym member ship fees.

I have received many emails from people who left Germany without properly closing their gym contracts, asking for help after being contacted by debt collection agencies. This can not only reduce your chances of reentering Germany but can also create problems when applying for visas to other countries. So please be careful.

There are other things that can have a negative effect like Changing bank accounts too often and a very weird one which is Moving too often.

Negative records can impact your score up to 3 years after you resolve your unpaid bills case and it can be kept as a “side note” for up to 6 years overall. Interestingly not paying your Radio Tax does not have any effect on your Schufa Score. But you should definitely pay that as soon as possible.

Why is Schufa so Important?

Having a good credit score in Germany is important as it can significantly impact your ability to obtain credit or enter into contracts. But many people struggle with that and get into debt. In this video I discuss Tips for Expats to Avoid Debt and in this video I share How I’m Growing My Net Worth as an Employee in Germany . So thanks for watching bleib gesund and ill see you in one of these videos!

Disclaimer: None of the content in this article is meant to be considered as legal, tax or investment advice, as I am not a financial expert or a lawyer and am only sharing my experience in Germany. The information is based on my own research and is only accurate at the time of posting this article but may not be accurate at the time you are reading it. Please check with multiple sources and make your own opinion based on that.